These days everyone is going through a tough time receiving money or sending money, thanks to the Vaahiyaat demonetisation rules imposed on us. Why vaahiyaat, is stuff for another post. However, till the time the instant removal of 86% of our cash flow is dealt with slowly and painfully, we can surely ease the pains we go through every day to pay for various services and goods.

Going Cashless can be done in many ways. Apart from paying through credit or debit cards and mobile wallets, one such option is UPI apps. UPI stands for Unified Payments Interface , a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund transfers & merchant payments – all into one. This system was launched by NPCI (National payments corporation of India) in April’16. Now all banks have started sharing their particular UPI enabled apps from August’16 onwards.

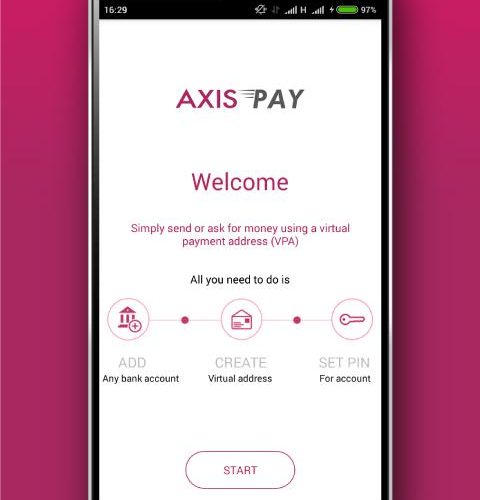

In this post, I will share some details about the Axis Bank UPI app, called AxisPay that I had the pleasure of using and experiencing lately. Axis bank was one of the earlier banks to come out with their app. It is very simple to use. Instant payments can be made vis this app, by using a Virtual Payment Address (VPA). One does not need to remember beneficiary details like account number, IFSC etc. Just Send money or Ask for money using a Virtual Payment Address.

Here’s a very quick 20 second intro of what all Axis Bank’s Axis pay UPI app can do

And here’s how to do it.

As you can make out, the steps are really simple. No matter which bank account you have, using this app, you can send payments directly to any other bank account holder as long as they are using any UPI app (similar to withdrawing cash from any ATM irrespective of bank account). So here are the steps.

- Download the Axis Pay app from Google Play Store (iOS version coming out soon)

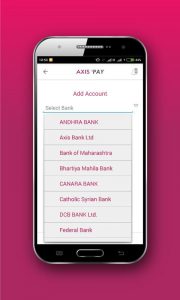

- Select your preferred bank account

- Create a unique ID (example – yourname@axisbank)

- Verify your account & set a PIN

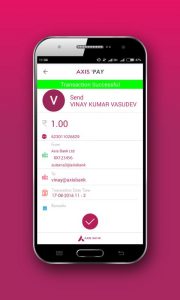

To send money:

- Select your & receiver’s unique ID

- Enter amount

- Send money by entering PIN

To receive money:

- Select your & sender’s unique ID

- Enter amount

- Receive money when sender approves transaction on his app

The best thing about making payments through the Axis Pay UPI app is that the money doesn’t go to a wallet with an additional step (and some charges) to transfer it into your bank account. It also uses two factor authentication, keeping it absolutely secure. As compared to NEFT, RTGS etc, this mode of money transfer is instant and can be done 24X7X365 without any fees to use your own money. One app can be used to make payments to anyone anywhere, as long as they are using any UPI app. You don’t even need an axis bank account to be able to use the Axis bank UPI app. Besides, there’s no need to remember or fumble around for bank account numbers and IFSC codes. You can even pay merchants & even do online shopping using this app. In fact, Freecharge has partnered with Axis Bank to launch UPI enabled payment on its Android app!

So go ahead and download Axis Pay UPI app to make your life easier!